palm beach county business tax receipt appointment

Constitutional Tax Collector Anne M. 2 hours ago 1.

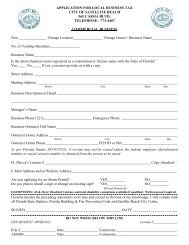

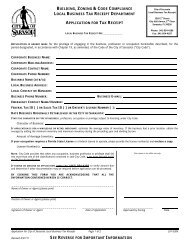

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Contact the Tax Collectors at 561-233-355-2264 or visit the website at.

. Call our Tourist Development. Business Tax Department PO. Business Tax Department PO.

If your business is based within Palm Beach County you must provide a Palm Beach County Wide Business Tax Receipt. Complete the top portion of the Application For a Palm Beach County Local Business Tax Receipt and receive sign off by the Royal Palm Beach Planning and Zoning Department. Palm Beach County Tax Collector Attn.

BUSINESS TAX APPLICATIONCERTIFICATE OF USE. Completed Village of North Palm Beach Business Tax Receipt Application Be sure to answer all of the questions completely including the narrative and notarize the signature Completed Palm Beach County Business Tax Receipt Application Do not go to the County Tax Collectors Office until. Business Tax Department PO.

Complete the Application for Local Business Tax Receipt. West Palm Beach Florida Mon. Businesses Based Within Palm Beach County.

401 Clematis Street West Palm Beach Florida 33401. Anyone who holds a County Wide Business Tax may purchase a Village Business Tax Receipt for a 2 fee. Walk in appointments are available if lobby space permits.

In 2007 the Florida Legislature amended the state statutes to replace references to Occupational Licenses to read Business Tax Receipt and the term Occupational License Fee was amended to read Business Tax Receipt. Contact Zoning at 561-233-5200 for more information. Palm Beach County Tax Collector Attn.

Please submit your business tax application or rental license application via email to. If the use meets the Zoning Code requirements then the applicant will pay a fee schedule inspections receive the appropriate sign-offs from zoning code enforcement and fire rescue then submit the completed form to the Tax Collectors office who will then issue the Business Tax Receipt. Box 3353 West Palm Beach FL 33402-3353.

Make an appointment at one of our service centers to process your completed application. Complete the Application for Local Business Tax Receipt. All businesses and professional offices within the Village must also obtain a Business Tax Receipt from Palm Beach County.

These fees are for the most common type of applications. Business Tax Receipt for Short Term Rentals are only processed at our administrative office on the third floor of the Governmental Center 301 N. Olive Ave 3rd Floor West Palm Beach Governmental Center 501 S.

Mail completed application to. Make sure to select Business Tax as your appointment type. These records can include Palm Beach County property tax assessments and assessment challenges appraisals and income taxes.

In general applications should be submitted to the County within 15 calendar days of. Palm Beach County Tax Collector Attn. FOR OFFICE USE ONLY.

Applicants must apply with the Village of Royal Palm Beach and obtain Zoning approval PRIOR to applying for the Palm Beach County Business Tax Receipt. Commercial locations must submit the following. Here is the link for the Application for Business Tax Receipt.

Box 3715 West Palm Beach FL 33402-3715. For specific businesses or if you are unsure please call 561-799-4216 for fee estimates. Constitutional Tax Collector Serving Palm Beach County PO.

Federal tax returns and requests for extensions for subsidiaries andor affiliates including all schedules if applicable. Palm Beach County Tax Collector Attn. However if the lobby has more than 10 people in it you may have to wait in courtyard until the lobby space becomes available.

Business Tax Department PO. THIS APPLICATION IS NOT A BUSINESS TAX RECEIPT OR CERTIFICATE OF USE. Applying For a Palm Beach County Local Business Tax Receipt.

O City of Palm Beach Gardens Business Tax Receipt. Business Tax Department PO. Palm Beach County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Palm Beach County Florida.

Palm Beach County Tax Collector Attn. You can call the Planner on Call line at 561-799-4222 someone is available from 800 am 500 pm. Box 3353 West Palm Beach FL 33402-3353.

CopyCopies of professional licenses or Certificate of Competency or permits. Office Edge Boca Raton is located within the City of Boca Raton which is part of Palm Beach County so clients should obtain both Boca Raton Business Tax Receipt and Palm Beach County Business Tax Receipt annually. All companies One-person and home based companies included in Palm Beach County selling merchandise or services are required to purchase a Business Tax Receipt.

Make an appointment at one of our service centers to process your completed application. Make sure to select Business Tax as your appointment type. A Business Tax Receipt is required from the Tax Collector and shall be reviewed and receive sign-off by Zoning prior to issuance.

Current Palm Beach County Business Tax Receipt and Municipal Business Tax Receipt when applicable. Make an appointment at one of our service centers to process your completed application. Local Business Tax Constitutional Tax Collector.

Do I need a City Business Tax Receipt if I have a Palm Beach County Tax Receipt. Please note that any business that opens or begins operating prior to obtaining an approved business tax receipt will be charged an additional penalty of 2500. Tenant occupancy in your business location.

A team member will. Complete the Application for Local Business Tax Receipt. Gannon is pleased to announce employees of the Palm Beach County Tax Collectors Office raised 2162850 in 2021 to support two local nonprofits.

Box 3715 West Palm Beach FL 33402-37152. Mail completed application to. APPLICATION REQUIREMENT GUIDE CHECKLIST Please complete application on reverse side.

Box 3353 West Palm Beach FL 33402-3353. All other applicants will pay full fee cost. West Palm Beach Fla.

Congress Ave Delray Beach. The most common fee is 33 and is charged to businesses with 10 or fewer employees. Living Hungry and Making Every Day Count.

Submittal Requirements for a City of Palm Beach Gardens Business Tax Receipt Commercial Business o We strongly suggest you speak with Planning Zoning prior to signing a lease or applying. Find Palm Beach County Tax Records. A copy stays with the Village.

Business Tax Receipt Select this type of service if you need to apply for a new local business tax or renew your local business tax. Return the original form to the Tax Collectors Office to obtain a Business Tax Receipt for Palm Beach County.

Fill Free Fillable Constitutional Tax Collector Pdf Forms

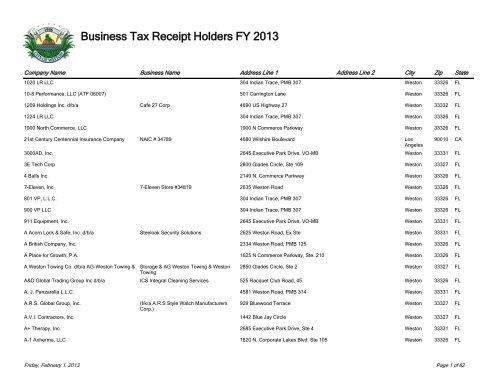

Business Tax Receipt Holders Fy 2013 City Of Weston

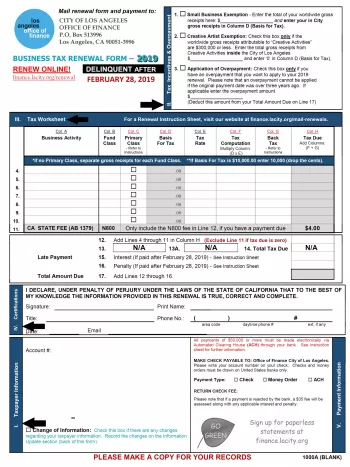

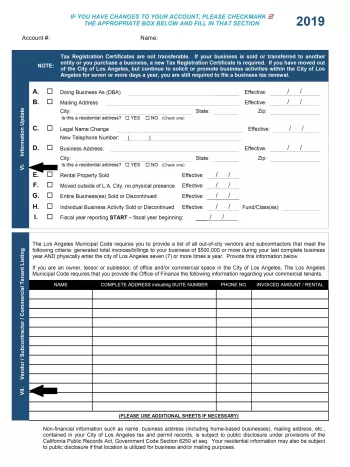

Business Tax Renewal Instructions Los Angeles Office Of Finance

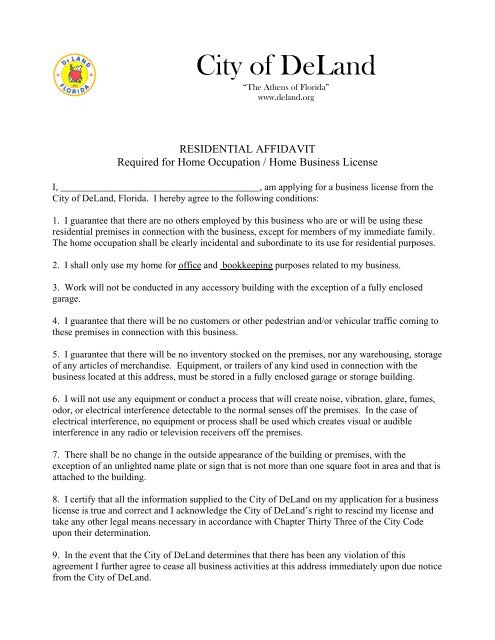

Residential Business Tax Receipt Affidavit City Of Deland

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Business Tax Receipts Citrus County Tax Collector

Business Tax Receipt How To Obtain One In 2022 The Blueprint

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Business Tax Receipt How To Obtain One In 2022 The Blueprint

Residential Business Tax Receipt Affidavit City Of Deland

Business Tax Receipt How To Obtain One In 2022 The Blueprint

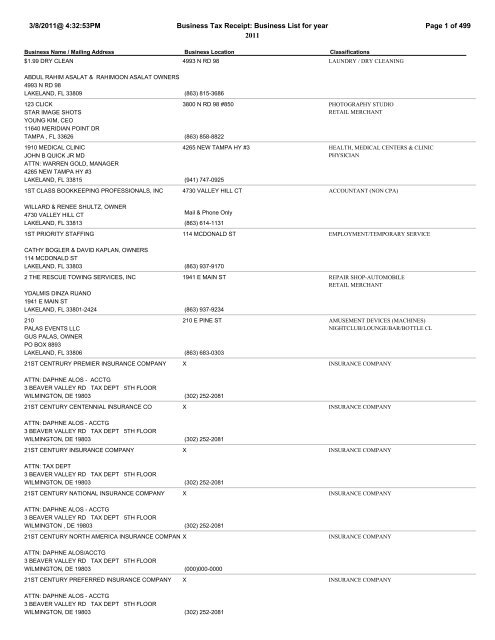

3 8 2011 4 32 53pm Business Tax Receipt City Of Lakeland

Fill Free Fillable Constitutional Tax Collector Pdf Forms

Business Tax Renewal Instructions Los Angeles Office Of Finance